McKinsey estimates the pandemic has accelerated digital transformation by seven years. Are traditional banks any more agile? Digital tools have come of age. Have any of our biggest banks mastered digital transformation? If automation is the – by now, well accepted – future of banking, why are their platforms sooooo slow?

For many customers today, this is largely a challenge of convenience. But as a new generation hits its financial stride, it could very quickly become an existential crisis for banks. Ellie Austin Williams is a financial educator and founder of This Girl Talks Money. In a recent interview with the Strategy for Breakfast podcast, she said: ‘The requirements of a bank for millennials and Gen Z are very different to those of previous generations. We’re a lot more financially insecure. We want to know a lot more about what is going on with our money. We want to have better oversight and we expect everything to be quick. And that’s just not what a lot of the old school banks can provide.’

Is this digital transformation?

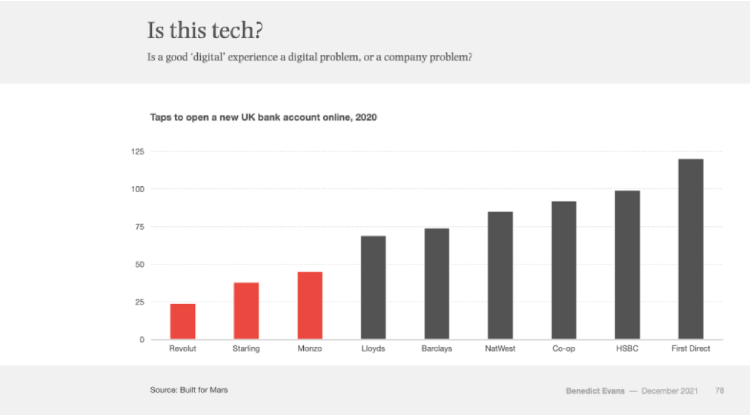

It’s a point brilliantly illustrated by independent analyst Benedict Evans, who has spent 20 years analysing mobile, media and technology. In his recent presentation, Three Steps to the Future he said: ‘It takes under 25 taps to open a new UK bank account online at Revolut. It takes 100 taps at HSBC.’ \

What is stopping the digital transformation of banking?

At a recent virtual event, we asked 80 senior executives from a mix of North American banks and financial services organizations: what is the single biggest challenge to digital innovation in banking? 12% said “a lack of leadership will”. 18% said “we do not have the business model in place”. 22% said “we do not have the processes in place”. And 48% said “legacy technology”.

It paints a complicated – and in legacy tech’s case, expensive – picture that helps explain the challenge of turning the world’s Main Street (and High Street and Wall Street banks) from enormous oil tankers into fleets of speedboats.

Agility demands action

But those financial services providers born digital see it more fundamentally. Ralph Rogge is CEO and Co-Founder of Crezco, a business-to-business open banking payments provider integrated with more than 300 banks and 400 million bank accounts across the EU and UK.

Commenting on the first anniversary of the Kalifa Report, which was commissioned to set the scene and strategy for FinTech in the UK, Rogge said: ‘There is a lot of talk about Open Finance, which is great, but anybody running an Open Banking company will tell you how much work is left to be done. This isn’t about raising awareness or recommendations, but action.’

That’s some catch, that Catch-22

Action is good. But maybe there’s a deeper issue that needs to be addressed first. This is from a recent McKinsey report…

‘The cultural shift is the biggest barrier to transformation in financial services … This is not a startling observation, yet the intricacies of behavioural impact on digital priorities in the financial services sector is a subject that requires deeper consideration. The financial industry has struggled to realise the benefits data can offer, to some extent due to the values advisors have had instilled in them since the dawn of time. “Customer data must remain 100 percent private”. “No one else can tamper with my customer’s information”. And most enlightening of all, “I know what’s best for my customer and have autonomy over what the data says.”’

How do you make banks “agile”?

Making traditional banks “agile” to enable faster development of and improvement to digital banking platforms in response to customer demand is about more than implementing agile methodologies. It’s about addressing some very deep-seated ways of working, creating new muscle memories and organization-wide neural pathways. It’s about more than buying a fintech for its product – banks need a big injection of that fintech culture too. It’s about realizing that very soon convenience plus growing trust will trump decades of trust plus growing convenience.

And, of course, it’s about a bias for action. To borrow from another industry… Just do it.

GDS Summits are tailored 3-day virtual event conferences that bring together business leaders and solution providers to accelerate sales cycles, industry conversations and outcomes. Regarding the NG Banking Summit 80% of Solution Providers said they would be interested in sponsoring future events and that same 80% agreed that in this ‘new normal’, GDS Digital Summits worked well and met or exceeded their expectations.

For more, click here to hear from attendees on how GDS has helped them to achieve their business outcomes.

Continue the debate at GDS’ NG Banking Summits where we bring together senior financial executives who are actively seeking to share, learn, engage, and find the best solutions.