At this point, it’s become clear that Covid-19 has triggered some of the most significant disruptions that the Banking Industry has faced in nearly a century. Sitting as it does at the front-line of the current economic disruption, executives within central, large and small to medium-sized banks are now being asked difficult questions about how to weather the current period of uncertainty.

Even prior to the current crisis, US commercial banks were dealing with a $1 billion reduction in net interest income from the first to second half of 2019, pair this with the threat of an impending financial crunch on top and things seemed pretty dire for banking in 2020, with efforts to get operations back on track facing unforeseen pushback.

Profitability & credit management, securitization, customer relationships and operational resilience – according to KPMG, all were negatively affected throughout 2020 and beyond, and to this end, executives and business leaders across the banking industry should now be coming together to search for the solutions necessary to negate disruption. It seems that now more than ever, the future of banking could well lie in automation.

Future of Banking: Investing in Strategic Automation

Automation has always been a priority within banking but never more so than now. Complacency has defined the industry since the start of the millennium and many businesses, since the start of the year, are paying for it. Where previously, many traditional banks could not see the need for more widespread automation, they’ve now been forced to realize that these technologies will prove essential to their survival both during 2020 and into the future of banking.

Artificial Intelligence & Machine Learning

There is a clear distinction between AI and Automation, in that Artificial Intelligence refers to algorithms which mimic human intelligence – useful for making decisions from data or recognizing patterns – whilst automation refers to machines autonomously completing repetitive tasks without human intervention.

Artificial Intelligence: AI is being used in the banking industry to enhance customer experience, predict trends, and provide realistic interactive interfaces. According to a report by the National Business Research Institute and Narrative Science, about 32% of financial service providers are already using AI technologies like predictive analytics & voice recognition. In short, AI enables banks to leverage human and machine capabilities to drive operational and cost efficiencies.

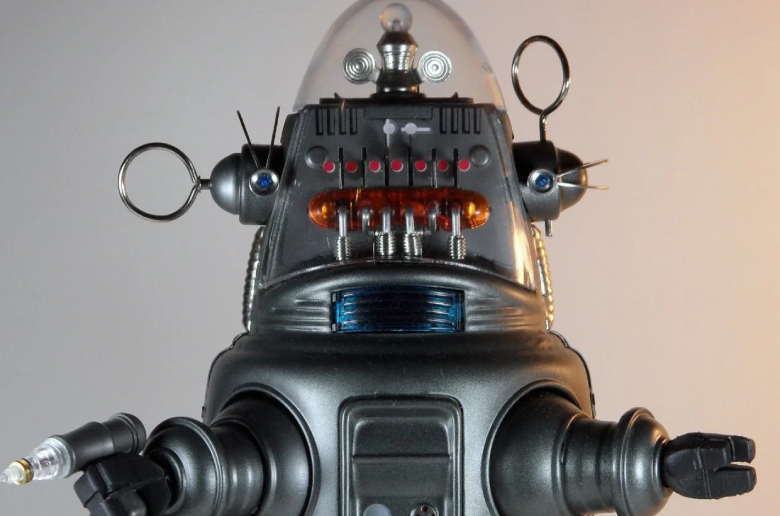

Robotic Process Automation (RPA): This is perhaps the most significant example of how the banking industry is looking to automate, initial reports state that the global RPA market investment may have reached $2.9bn in 2020. The primary aim of RPA in the banking industry is to assist in processing repetitive banking work, helping on everything from automatic report generation to customer onboarding.

Machine learning: Focuses on developing computer programs that autonomously learn and improve from training data. Top banks in the US like JPMorgan, Wells Fargo, & Bank of America are already using machine learning to provide customer support, detect fraud in real-time, manage customer data and undertake risk modelling for investments. By experimenting effectively with all of these technologies, executives are one step closer to delivering the future of banking.

Human Vs Automation

A recent report from Wells Fargo suggests that automation will lead to a loss of 200,000 banking jobs in the next 10 years. For perspective, 200,000 makes up 13.3% of the 1.5 million US jobs predicted to be lost in the same period. This is obviously a significant loss and certainly agrees with the broad trends we’re seeing with applications of automation across banking. However, executives should be cautious.

There is a careful balance to strike between automated and human solutions in any industry but finance can be very delicate. AI, offers significant opportunities for improving our understanding of audiences and sectors based on the gathering and assessing of massive tracts of data but, at the moment, it is not truly effective at replicating the human and for many institutions, it could end up doing more harm than good.

Finances are an inherently private issue, and the simple truth of the situation is that most consumers prefer talking about these matters with a real person, in fact, as much as 86% of consumers prefer talking to a human over a chatbot. To this end, when considering the technologies an organization uses to bring about the future, executives must first question how it affects their staff and consequently, their image. Doing so will help them to realize the future of banking.

GDS Summits are tailored 3-day virtual event conferences that bring together business leaders and solution providers to accelerate sales cycles, industry conversations and outcomes. Banking Innovation: 80% of Sponsors said the quality of their 121 meetings was either Above Average or Excellent, whilst 80% of Sponsors said they would be interested in sponsoring future events.