“There’s a traditional Chinese curse that goes, ‘may you live in interesting times’. There’s a new curse that’s gaining popularity these days and it’s ‘may you be a banker in interesting times’.” – Ron Shevlin, Director of Research at Cornerstone Advisory Services and Senior Financial Contributor at Forbes Magazine.

The future of banking is uncertain. Whether it’s the pressure of digitization, changing consumer behavior or defining a post-pandemic response, the challenges that banking faces in 2021 have become so disparate that it’s difficult to know where to begin. Banking, sitting – as it does – at the front lines of change, cannot afford to focus only on keeping money out of the hands of malicious actors, instead, it requires an agility and presence of mind that will allow it to pivot to any issue both now and into its future.

Only through overarching structural change can banking counter the threat of challenger banks, the sustainability issue and a world in ever-growing flux. From IBM’s Sanjay Tugnait, who shapes the future with his focus on sustainability, to ServiceNow’s Gregory Kanevski and his mission to realize more compliant customer operations, here are just some of the senior leaders in the field on how they plan to define the future of banking.

-

A Changing Face for the Future of Banking

Covid-19 left society constrained, but connected as life online became the norm. Forced to watch the first global pandemic of the digital age work its way across the globe, consumer behavior had to adapt quickly to the ‘new normal’, ergo, a life lived by laptop, phone, and tablet. Ron Shevlin, one of Forbes’s Senior Financial Contributors and Director of Research at Cornerstone Advisory Services, sought to explore this changing face of banking, landing on three key areas of focus that banking executives cannot afford to avoid.

Consumer Behavior shifted dramatically in 2021. Driven in great part via remote work needs and heightened access to technology, this was no different in banking, and as Ron suggests, “mobile banking and digital account opening rates skyrocketed during and post-pandemic.” Ultimately, Ron sees the lockdown as a catalyst, rather than a cause of this shift, stating that the “changing payment behaviors, changing investing behaviors, changing savings behaviors” were not born from the pandemic but had been “growing for a number of years”, Covid just exposed the need for change.

Challenger Banks are growing to contest the monopoly of traditional banks, such that Ron looks at 2020 as the “challenger bank insurgency”, particularly as it was the year that a number of consumers began to use them as their “primary checking accounts”. Traditional banks often attribute the success of the new banks to accessibility or seamless UI, but this may not be the case, as Ron states, challenger banks are, “winning on product differentiation, they’re also not challenging traditional banks head on, they’re nibbling away at the edges of their customer base,” in doing so, they provide a competitive product that closely targets certain customers to provide them with greater value.

Embedded Finance was the third and final area in which Ron anticipated the greatest change. Referring to “the integration of financial services into non-financial websites, mobile apps, and business processes”, embedded finance is an area in which Ron sees the next big battle in banking being fought. To capitalize on this notion, Shevlin suggested that “banks don’t need to innovate”, but rather should focus on “understanding what is happening in the market around innovation,” to help to go after the solutions which matter most, whilst driving change.

-

The Value in Greenfield for the Future of Banking

To meet the changes identified above, it’s become essential for leaders to iterate and amend their processes and increasingly, greenfield could be the means by which they do so. Greenfield projects – which disregard the existing assets and capabilities of a business to instead create new products or propositions – have become an increasingly valid means of encouraging change in the traditional bank, a place in which change is often costly and complicated, occurring gradually.

Though greenfield may appear promising for banks looking to reinvent themselves, all too often things don’t go to plan. With a number of components to consider, as well as the complexities created by competing priorities between the greenfield and incumbent approach, success is by no means assured. It was on this matter that David M. Brear, CEO and Co-founder of 11FS, came to address our delegation, clarifying that the solution might not be incremental change, but wholesale.

Covid-19 helped to institute a shift in the market that must be capitalized upon and consequently, there has never been a better time to consider the greenfield approach. As David suggests, “market changes have brought about a confluence of forces that have changed the competitive landscape in financial services”, chief of which is digital banking, which he states, “is really only 1% finished, but has a huge potential to shape what it means to be a financial services player in this day and age.”

Similar to Ron though, David suggests that these changes have been in play for a number of years and that “what really happened from 2008 onwards with the rise of everything that we’ve seen in regards to FinTech, extra access, and the pursuit of intelligent digital services, has really changed the emphasis of where everyone’s headed.” We need to be more reactive to move with the tide of the digital world and greenfield will be key here, this is how neobanks have proven successful after all.

Neobanks can afford to be more innovative as they lack the responsibilities of traditional banks, and it’s for this reason that “we’re seeing 20-25 people in a small start-up able to achieve something that gigantic organizations are struggling to do.” It’s easier for a neobank to embrace greenfield as there is less riding on failure, for larger organizations looking to institute the approach what should they consider then? According to David, it’s a chicken and egg issue, “if you don’t have the right technology, you’re not going to be able to hire the right talent, you’re not going to create the right culture, and you won’t retain the talent that you want to have within your organization.”

Organizations must have each of these features in place when looking to go greenfield. Only through them can we effectively provide solutions which add value. Ultimately, these solutions will “need to be real-time, need to be intelligent, as well as contextual, human, extendable and social,” to be considered successful; the greenfield approach could well prove the best means of realizing this.

-

Personalized, Responsive Experiences are Key to the Future of Banking

Whatever the model, whether you’re a traditional bank, challenger bank or private firm, you cannot afford to overlook a compliant personalized and responsive customer journey. If – as Ron Shevlin suggested above – consumer behavior has shifted, then it is time that the customer journey that we provide effectively mirrors that. How then, can senior finance leaders ably provide an experience that is both useful for customers and also complies with current regulatory standard?

Serving as the Global Head of Banking for ServiceNow, Gregory Kanevski, understands the importance of building up a peerless customer journey and in his keynote discussion, he sought to explore the best means of instituting one whilst also addressing the potential compliance issues that could arise therein. In his own words, “you have to look least and west, as today’s products and solutions need to solve more than one problem.” To do so, ultimately, the new customer journey will depend on three primary considerations.

Technology: Similar to the success of a greenfield approach, an effective customer journey must be supported by the appropriate tech stack, as “without the technology underneath to support, you can’t make the changes necessary in order to stay agile and move with the environment”. Of notable importance, is how tech helps us to make use of data, as “it’s all about the data, but it’s all about not perverting the data further and it’s democratizing it to really weaponize it for what you need it for”.

Speed: Moving at pace will also prove critical to a seamless customer journey. Consumer expectation may have shifted due to Covid, but it is ever-shifting; this means that ideation, production and iteration must move faster than ever before. As Gregory put it “rapid deployment really has to be rapid, I’m not talking about a year, I’m talking about weeks.” If your customer doesn’t like the service that you provide, they will go somewhere else. Consequently, speed is of the essence.

Flexibility: Finally, we need to be more agile; a quality best achieved through heightened flexibility. This flexibility must be all encompassing and as Gregory established, this means “flexibility in the distribution, flexibility in the process, flexibility when providing transparency.” Ultimately, the journey that we provide need to be malleable, capable of drifting in the same direction as the consumers present interests, and “if a platform today does not provide that type of flexibility and resiliency then the cumulative value for the organization is not there.”

All of these factors help to ensure that the customer journey is consistent and compliant. Truly, this where the true value lies as, “if you can’t provide a consistent experience, how can you provide a directed experience?”

-

The Future of Banking and its Open Source Opportunity

Though innovation within banking was deemed as important by 87% of respondents in PWC’s 2020 Future of Retail Banking Report, only 11% believed that their organization was well placed to develop new products and customer experience approaches. To counter this, we’re seeing companies look to redress the balance through open innovation in greater and greater numbers. Serving not only as way for companies to share risk and accelerate new approaches – particularly around technology standards – it is fast becoming the secret weapon of banking leaders, but why?

This is the question that Gabriele Columbro sought to answer during his keynote discussion at GDS’ Banking Innovation summit earlier this year. Serving as the Executive Director for FINOS – an open source community of over 40 member organizations who are all collaborating, sharing data and working towards exciting customer innovation – Gabriele is an open source leader & technologist with over 10 years of building thriving communities and delivering business value with open source.

For Gabriele, open source is a foregone conclusion in banking, outlining that “it has the unique potential, beyond code, to create a level playing field for pretty much any constituents”, adding that “as a collaboration methodology it can deliver value at pretty much any level, regardless of your maturity.” For too long, traditional banks have subsisted on competition, but the future of banking will depend on our ability to embrace collaboration, by using open source we can help realize this growth and give results back to consumers.

In spite of the obvious advantages of open source, there is still work to be done and as Columbro established, though “we are on the right path we know that there are still a huge amount of financial institutions that look at open source as something to fear.” Essentially, we need to debunk many of the myths that surround open source. Whether it’s ease of maintenance or uncertainty around security, ultimately, “open source is about trust” and it’s time that banks were helped to realize it.

Perhaps the most enriching quality of open source though is that, “the more you contribute, the more you’re going to have a say in how a project can evolve,” which positions your organization both as a thought leader and one with significant sway in the industry. Open source will prove critical to banking in the future and though “we’re seeing collaboration that’s driven directly by the business” increase, we need a common rule across the industry in order to drive real value leading to 2030.

-

How Sustainability is Vital to The Future of Banking

Though banking might seem to be an area of relative environmental impact at first glance, if the UK’s big banks and investors were a country, they’d be 9th in the world for carbon emissions according to the WWF – generating almost twice the amount of greenhouse gases as the UK itself. Pair this with the recent Bloomberg report that many US banks produce 700 times more emissions from loans than offices and it becomes clear that the high carbon footprint of banking needs to be curtailed.

For Sanjay Tugnait, Chief Market Maker and Global Managing Partner for IBM’s Sustainability Practice, finding a solution to the banking industry’s carbon problem is vital. Specifically, Sanjay works to develop and shape IBM’s value propositions in sustainability, conclusively helping the banking industry to do its bit to prevent climate change. This – as well as the tech supporting ESG, impact investing & sustainability – formed the focus of his keynote talk.

Finance has changed and as Sanjay suggests, where “the last decade in banking was all about digital and digitalization, the next will be defined by sustainability”. While environmental sustainability remains a primary aim for leaders in most industries, banks still aren’t doing enough. However, now, there’s an opportunity: “for the first time, countries, companies and consumers are aligning themselves”, such that “it’s not just fashionable to talk about sustainability, now its mainstream.” We are at a stage where consumers will no longer tolerate environmental negligence from a major business, consequently, “unless you have sustainability as your core strategy, you will not survive”.

Banking executives need to strike while the iron is hot, and Sanjay offered up several tips on how they can do this most effectively. Notably, he stated that to keep abreast of your sustainability progress, “the four most important things that any CEO must do at the heart of sustainability is to capture, measure, benchmark and report”. Only by collating & weaponizing the data that we produce, can we identify room for improvement and then work to achieve net zero goals

Ultimately, “banks follow the money,” and consumers will abandon a provider that doesn’t look to reduce emissions. This means that, “starting tomorrow you need to engage in your own journey towards sustainability,” or risk the consequences. As a final tip to help achieve this, Sanjay stated, “look at what the ESG goals for your companies are and be the change agent to make sure that you are providing the technology and leveraging all of the ecosystem partners,” only by doing so can we realize a sustainable future.

-

How are the Unbanked critical to The Future of Banking

The unbanked represent a substantial and untapped segment of the economic market. To put a number to just how many people currently sit outside of its coverage – and according to some of the most recently available statistics – in 2017, there were 1.7 billion unbanked individuals globally. Over the last four years however, both access to technology and technological literacy have increased, this means that there has never been a better time for banking executives to cater to the unbanked.

Brian Richardson, CEO of Wizzit and world leader in financial inclusion, has dedicated his professional career and mobile technology to help bring banking to every person on earth. In his keynote discussion, ‘Banking the Unbanked’, Brian sought to outline the ways in which he helped provide banking systems to communities in rural Africa and how companies of all types can replicate these strategies to aid and eventually protect some of the more financially vulnerable in society.

Reflecting on the fact above, Brian stated, “it’s sad to reflect that there are still around 2 billion people on this planet of 7 billion who do not have access to financial services.” However, as he added, “cash does have a few uses that digital cannot meet, it is untraceable, it is anonymous, it is untaxable for many people, it’s free to keep &, it’s free to use”. Though this is obviously a little tongue-in-cheek, our capacity to attract the unbanked will depend on our ability to provide experiences which outmatch these advantages. The answer, increasingly, must be found in digital.

As Brian put it, “digital is more than cards” and truly, we are only just beginning to scratch the surface of what tech-enabled banking can do. Notably, digital channels afford a convenience and efficacy that cash simply can’t replicate. As Brian noted, “we’ve proven over the last 16 years that you do not need a physical infrastructure in order to do banking,” and truly, in the digital world, we’ve moved past the need for branch-based banking, in the day-to-day, it’s time to share that notion with the unbanked.

Banks also need to offer more valuable experiences to customers by leveraging digital. To meet the unbanked they need to provide an experience which slots readily into their lives and existing apps, for example, Brian suggests, “if people are spending so much time on their instant messaging platforms, doesn’t it make sense that their banking is transferred to those same channels?” If the unbanked aren’t banking out of a perceived inconvenience, we need to ensure that the opposite is true.

Equally, we need to define what we want our banks to be, “can a bank or should a bank be all things to all people? Can it effectively and efficiently serve all the segments of the market, including the unbanked? Or do we require more specialized banks who’ve got a passion to do that?” Banks must figure out who and what they want to be, and to then pursue that intent above all else, after all, “if you don’t have the passion to do something, leave it to somebody else.”

Post-Summit Reporting – Banking Summit 2021

GDS’ Banking Innovation summits bring renowned senior banking and finance executives together to connect and provide insights. If you are a leader in the space, don’t miss out on the opportunity to engage with other Chief Executive, VP and Director Level Leaders who are driving change both now and into the future of banking.

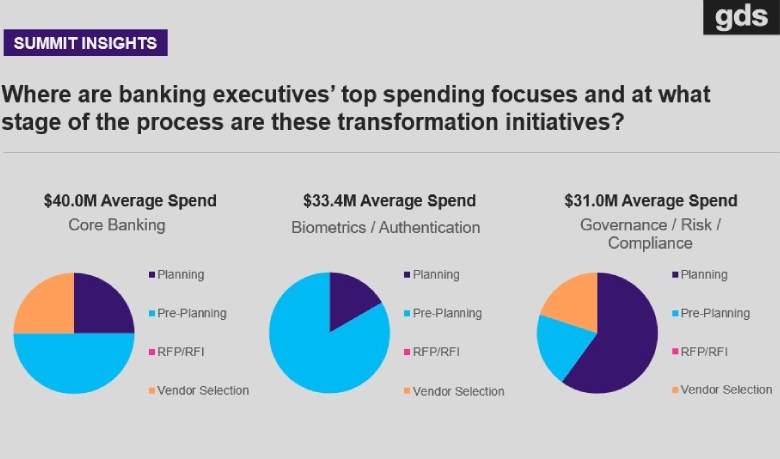

Not simply comprised of the keynotes we host, summits also provide interactive Q&A and polls as well as breakout sessions, roundtables and 1-1 business meetings with executives. Across each of these, we asked leading marketing executives and providers about their top spending focuses and at what stage in the process they were in implementing these transformation initiatives, the results of which can be seen below.

Given the latent threat posed by the neo and challenger banks, it’s not all that surprising that many senior leaders in banking are investing heavily in their core banking systems. Banks have never been shy about investing their money to stay ahead of the competition but with an average yearly spend of $40 million, it becomes clear both how seriously incumbents are taking the threat of challenger banks, as well as the yearly focus that leaders pay to continually renovate their services.

Security and compliance round out the requirements for banking with investment of $33.4m and $31.0m respectively. It’s not hard to see why this might be the case, consumers expect their money to be safe whilst regulators expect banks to operate within the law, a failure to work to both will prove detrimental to any provider. Ultimately – yet unsurprisingly – the three primary investment concerns are committed to the three things that banking cannot operate without: compliance, protection, and the systems and service that it provides.

Banking Innovation NA April 2021 – In Review

If one thing became clear from the GDS Banking Summit in April, it was that increasingly, there is a widening front on which banking must deploy its resources. Even with its deep pockets, the industry faces systemic change that requires new thinking, new products, and new ways of tackling age-old challenges. For those in banking it may seem like we are spinning plates, prioritizing reactivity over proactivity, but as we heard from our distinguished speakers, it’s clear that tangible solutions are within grasp, we only need to change our thinking to adopt them.

To manifest the future of banking, banks of all description must be more sustainable, collaborative and inclusive if they are to future-proof operations and guarantee success in their challenging and dynamic market. It’s time to ask more from banking, and it seems that a select few are already on their way to providing it.

GDS Summits are tailored 3-day virtual event conferences that bring together business leaders and solution providers to accelerate sales cycles, industry conversations and outcomes. Regarding the NG Banking Innovation Summit 88% of Delegates said their overall experience was Above Average or Excellent and 100% of Delegates who responded said the summit provided them with actionable outcomes to support their current initiatives.

For more, click here to hear from attendees on how GDS has helped them to achieve their business outcomes.

Continue the debate at GDS’ NG Banking Innovation Summits where we bring together senior marketing executives who are actively seeking to share, learn, engage, and find the best solutions.