“We need to understand that today is the least digital this world is ever going to be. That was true yesterday, it’s true for tomorrow and it’s true today” – Jim Claunch, Senior Advisor, Bain & Company.

2020 was both a year of dispiriting industry firsts and inevitable legacy issues for the Energy sector. In regard to contemporary issues, the global humanitarian crisis triggered by Covid-19 prompted extensive lockdown procedures, unprecedented decline in demand for Oil & Gas and the third price collapse the sector had experienced in 12 years. This is all without acknowledging the aforementioned legacy issues being faced in the industry, which will all need addressing in the leadup to 2050, namely a focus on future energy sources, emission reduction, and digital transformation.

These are the challenges that executives like Jim Claunch, Senior Advisor for Bain & Company and Ranjan Ghosh, Digital Strategy Leader at Chevron face and with this in mind, here are 7 of the most senior leaders in Oil & Gas on how they have contended with these challenges, how they plan to overcome them and how this will help them to benefit from future energy sources. Consequently, executives in the field must pivot to focus on the following energy trends in 2021.

1. ESG & Leadership

Jim Claunch is a Senior Advisor for Bain & Company, the American management consulting firm headquartered in Boston, Massachusetts. He is a digital pioneer with over 35 years of experience in the Energy sector and with proven thought-leadership and digital transformation expertise in the upstream sector. In his role, he is helping industry leaders to develop coordinated, industry-wide solutions.

In his keynote discussion at the Energy Digital Summit, Jim explored the approaches that could help groups in the sector to leverage digital to reduce their carbon footprint, better prepare leadership for ESG efficacy, and effectively build towards a data-driven future of energy. The takeaway? That the plans to reduce carbon emissions cannot continue without an effective union between digitalization projects and the sustainability process. Essentially, as Jim put it, “decarbonisation and sustainability have got to be linked into how work is done”.

Conventionally speaking, the energy sector has struggled to address and rectify its environmental impact, but it isn’t enough to remain quiet. As Jim indicated, “as an industry, we have to have an opinion on decarbonization and sustainability. Whether we’re an Oil & Gas company until we close the doors, or whether we’re focusing on renewables, we have to an opinion”. Increasingly, it will be the leaders in energy that have to realize this policy; that could be through alternative energy sources like solar, wind or hydro energy or in conventional oil and gas, whatever it may be, “we need leaders that understand the power of data, digital and new ways of working” to help get us there.

Consequently, Jim suggested that, “as we go through energy transition, one thing that we cannot do is go into it building an industry that scales with people. We need to approach going through decarbonisation, data and digital first”. To do so, he added that leaders need to cater to the next generation of workers, stating, “millennials want to work with the latest and greatest digital tools, and the ones that I’ve worked with, they solve things digitally, leveraging and collaborating around data and being data informed”, only then can the energy sector start to realize their future energy goals. Goals like energy diversification, natural resource sustainability and a push towards Net Zero.

2. Net Zero

Net zero or carbon neutrality refers to the balance between the amount of greenhouse gas produced and the amount removed from the atmosphere and for those in the energy sector it’s an obvious North Star to aim for. This formed the basis of the discussion between Tracy Beam, Angela John and Joanne Howard, CEO of Strategic Transformation Partners, Development Director of Renewables & Emerging Technology for Williams and VP of Sustainability & Corporate Communications for Crestwood Midstream Partners respectively.

While ‘net zero’ green house gas emissions are not a national goal for the US, many states like California and oil and gas behemoth, Louisiana have pledged to reach ‘net zero’ by 2050. If there is going to be meaningful action on climate change, oil’s market share in the energy complex must fall, but how? Tracy suggests that “to crack the code of Net Zero, it’s going to take a multiple solution approach through innovation and technology, improvements to policy and infrastructure, strong partnerships across the ecosystem and the ability to collectively change the narrative”.

Shifting the narrative in energy is of particular importance as change cannot, nor will not occur without industry-wide agreement on net zero goals, fortunately, it’s a discussion we’re seeing more enter into according to Angela; “the conversation is moving more towards what we will do about ESG, rather than how we can measure it, to make a difference for the future”.

Whilst we have taken key steps to begin the transition to carbon neutrality and whilst the oil & gas industry outlook appears less and less favourable, it’s important to remember that change won’t occur overnight, as Joanne suggests, “there’s no silver bullet with any of this. Oil & Gas is predicted to have the lions share of the market leading up to 2050, but from 2030 to 2050 we need to get other technologies up to scale”. In short, energy needs to alter the net zero outlook and determine the future of the oil industry, as it “is not just a challenge but also a tremendous opportunity” according to Tracy.

Covid-19 led to a sizeable reduction in emissions in the first half of 2020 and according to Joanne, this has encouraged a shift in attitude and focus on future energy sources; from “2020 and into 2021, we’ve seen an acceleration in the energy transition and all things ESG”. In spite of this, emissions were still able to bounce back substantially in the latter half of the year, and in 2021 global energy-related CO2 emissions are projected to rebound and grow by 4.8% as demand for coal, oil and gas rebounds with the economy.

Ultimately, as Angela stated, “the goal is to limit climate change”, but in order to do so we need to invest in the future energy solutions that will best help us to achieve this end, with this in mind, Oil & Gas giants must prioritize effective digital transformation and digitalization initiatives to realize results.

3. Digital Strategy

With over 20 years of experience in the management of corporate technology operations for top-tier, Fortune 500 companies, Ranjan Ghosh has had an exceptional record of success working for tech and energy organizations like ABB, GE and now, Chevron. In his fireside chat with GDS, he discussed his role as Digital Strategy Leader for the company, what it really means to construct a digital strategy, and how the digital focus will and should shift in the industry within the next 5 years.

Ultimately, it’s hard to realize competitive advantage in the wake of Covid-19, particularly in the energy sector and this is why it’s so essential that groups form an effective digital strategy, there is, after all, no point in onboarding technology without a blueprint. It’s a point which Ranjan agrees on; “digital for the sake of digital is never effective, you need to be able to show the benefit that each piece of technology is going to bring in for the operators doing the work day in, day out”.

According to research from McKinsey, 70% of digital transformation initiatives fail and due to this, Ranjan encourages all energy companies to alter their approach when planning a digital strategy, outlining that “the first thing that company’s need to do is change their image, their image needs to change from an industrial company to a digital industrial company”. Oil & Gas groups need to move away from thinking about the future energy trends and towards the people and technologies who are disposed to deliver it as “digital strategy is not just about technology, it’s about business engagement, it’s about bringing everybody together”.

Resultingly, before the end of the keynote, Ranjan was keen to address one of the more popular misconceptions where digital strategy is concerned, namely, the difference between digitalization and digital transformation. As Ranjan put it, “digitalization is about keeping your current business process as is and using technology to make it more efficient, it is about removing your manual and paper process and digitizing it. Digital transformation on the other hand, is about transforming your organization in a way that builds competitive advantage”.

Digital transformation efforts predate Covid-19 by quite some margin, a point which Ranjan even acknowledged but as he states, “I believe that process will expedite over the next few years as we start to think more about renewable energy and energy alternatives of the future”. If this comes to pass, we can expect businesses to further their digitalization to stay ahead of the curve.

4. Digitalization

Ilya Berchenko is an energy industry professional with 25+ years of global experience leading digital technology deployments. In his current position as General Manager of Digitalization, Assets, Projects, Subsurface and Wells, he is focused on leading Shell’s efforts to transform its business through digitalization, live asset management systems, and the introduction of a team of innovative digital product managers.

It’s crucial work for Shell, who see future energy solutions and digitalisation as the two mega trends most likely to affect the world in the coming decade, and it’s a point that Ilya was keen to acknowledge, “Shell has set its own target to become a Net-Zero energy emissions business by 2050 and digitalization is set to have a significant impact here”, helping the business to chip away at its emissions. Evidently, digitalization is the means by which the oil & gas giant is looking to tackle both of the major mega trends in the space, but how specifically does this help?

The great difference between digital transformation and digitalization, according to Ilya, is that, “digitalization is all about data leading to actionable insights”, rather than technological innovation leading the way. In effect, “the digitalization journey starts not with technology or with technologies but with the problems that we need to address”, and consequently allows for more iterative, data-driven changes to be instituted, which in turn, help to seamlessly address the businesses commitment to future energy needs.

Although a digital strategy can allow organizations to address some of the pressures of pricing and access to new assets, the data-driven approach that digitalization is led by will prove invaluable in the coming years, particularly where condition monitoring and real-time data are concerned. With this in mind, Ilya had an important suggestion for those looking to invest, “to achieve successful digitalization and successful data conversion into insights, you must work from both sides, from left to right internally and right to left for the customer and end-user to find the proper balance”.

The fact that digitalization allows for a customer-centric and company-specific approach means that we can truly follow the data, and go for the solutions which contribute to the future of energy, as Ilya suggests, Shell sees advantages quickly; “the beauty of digitalization for us and just digital products, is that we see return on investment in 3-6 months”. Results like this have made digitalization veritable, and increasingly, big data, IoT and blockchain have risen in essentiality.

5. Blockchain

Raj Rapaka is an Advisor on the Upstream Digital Transformation Organization (UDTO) within ExxonMobil and has over 20 years of experience across various companies and sectors. On the UDTO team, he is the VC and start-ups contact for transformative and disruptive technologies and coordinates their adoption within the upstream organization. Additionally, he is a board member of Blockchain for Energy, a non-profit consortium of energy experts looking to leverage blockchain technology to maximize efficiencies, reduce costs, improve timelines, and drive transformation for the future of energy.

In our conversation with Raj, we sought to explore what Blockchain technologies are and what they are not, as well as the benefits for blockchain within the energy sector as we consider the future of the industry and as we progress towards 2050. To begin then, what is blockchain? On being asked this question Raj stated, “first, let me start with what Blockchain is not. It is not bitcoin. Blockchain is a distributed ledger of transactions, that are replicated and synchronised across all the nodes – or computer participants – across a network”. Essentially, it is a data structure that makes it possible to create a digital ledger of information to be shared across a network of independent parties.

It’s not difficult to see how this could be valuable for energy suppliers as it provides a decentralized structure with improved security and privacy, but as Raj suggested, “blockchain typically excels in the external space because one of the primary issues it solves is trust”, essentially blockchain is valuable as it can encourage partnerships between entities where trust is either non-existent or unproven. Blockchain in the energy community must be built out from this benefit and this is where groups like the non-profit consortium, Blockchain for Energy comes into play.

In Raj’s own words Blockchain for energy “provides a safe venue for creating transformational change for the energy industry, by the energy industry”, and we can expect agreements and communities like these to increase substantially leading up to 2050 in order to overcome the heavily siloed nature of the industry and to deliver on future energy needs. Oil & Gas giants have awkward questions to answer in the intervening years and similar to the conversation shared between Angela, Joanne and Tracy, it’s clear that these industry-wide challenges can only be established once the industry works as one.

Post-Summit Reporting – Future Energy Trends 2021

GDS Summits bring renowned senior executives together to connect and have their voices heard. If you are a leader in the Energy industry, don’t miss out on the opportunity to engage with other Chief Executive, VP and Director Level Leaders who are driving change both now and into the future.

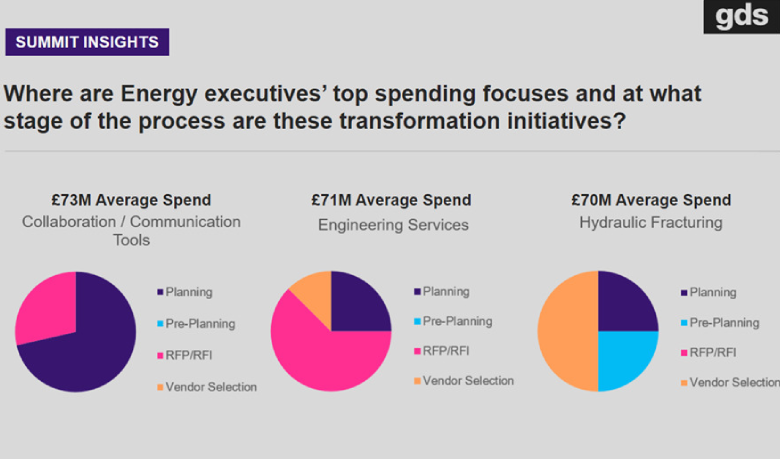

Not simply comprised of the keynotes we host, summits also provide interactive Q&A and polls as well as breakout sessions, roundtables and 1-1 business meetings with executives. Across each of these, we asked leading Energy executives and providers about their current priorities and how far along they were in implementing them, the results of which can be seen below.

As we approach the future of energy, what will separate the winners from the losers in the sector will be the extent to which they join the executive conversation. The issues of alternative energy, decline in demand and environmental impact are too broad to be confronted by any single company and, as such, require proportionate attention to tackle. As we can see, it’s already an area that executives in the space are looking to confront with £73 million on average invested in planning and implementing the solutions that will help companies to better collaborate and communicate.

This is also reflected not just in company average spend but in a point which Ranjan Ghosh touched on during his discussion at the summit where he suggested that Covid-19 was also responsible for the surge in investment, “crises are never good, but they can help in certain cases and areas. Across the entire industry landscape we are all doing a lot more remote work, more collaboration through digital, something that many of us never really thought of doing in the next 5-10 years”.

Inversely and based on GDS’ research, we can also see that completion and production technologies were areas in which executives were willing to invest less. Ranjan also covered this during his keynote speech when he stated that as we push towards renewable solutions and away from fossil fuel, naturally the technology and funding necessary to construct new oil wells will decrease, specifically, Ranjan stated, “I believe that process will expedite over the next few years as we start to think more about renewable energy and the energy alternatives of the future”.

Steve Bitar echoed this when he outlined that “technology is the least of all the problems we have to worry about, if you look around the industry there’s nothing new about this idea.” Instead, we need to become more transparent with others in the sector, sharing the data that helps us to drive environmental and ethical change to deliver the future of energy. In effect, this future of energy will be driven by collective agreement and as Jim Claunch suggests “we’re going to have to get better at leveraging other people’s data and sharing that data when it comes to cracking this code of decarbonisation, sustainability and energy transition”. Failing to do so could prove devastating.

Energy Digital Summit June 2021 – In Review

Few industries are bound by regulation and overarching ESG objectives in the way that energy is. 2050 has loomed large on the horizon for many in the sector and increasingly, the pursuit of net zero and alternative energies has come to dominate executive thinking. Pair this with the step changes instituted by Covid-19 and it becomes clear that the energy sector will exist in a state of almost perpetual flux in the first half of the 21st century.

Based on the insights generated from GDS’ energy summit and thanks to the words from our esteemed speakers however, it’s clear that though the challenges that the energy industry faces are substantial, the conversations necessary to help solve or ease them are already well underway. As a result, the energy providers of the future will be more collaborative, iterative and open to the future energy trends of 2021 ; they will understand their need to renovate rather than endlessly innovate, and most importantly they will adopt whatever method necessary to ease, and ultimately prevent their impact on the environment. In this way, the future of energy is secure.

GDS Summits are tailored 3-day virtual event conferences that bring together business leaders and solution providers to accelerate sales cycles, industry conversations and outcomes. Hear from attendees on how GDS has helped them to achieve their business outcomes, here.

Continue the debate at GDS’ biannual Energy Digital Summit where we bring together senior Oil & Gas executives who are actively seeking to share, learn, engage and find the best solutions.